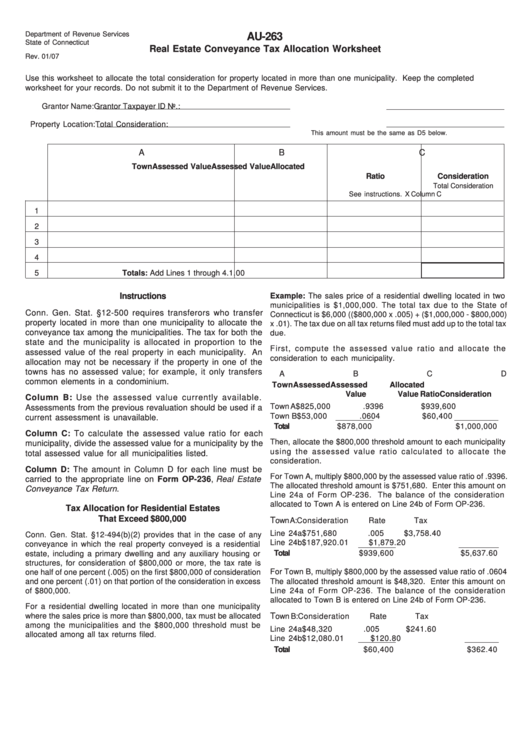

New York has many local optional taxes that vary by county. Look for mortgage recording taxes, too, in New York City. In New York City, transfer taxes can amount to 2.625% of a property’s value. The New York State transfer tax rate is $2 per $500 of the home price, plus a 1% “mansion tax” for homes selling at $1 million and higher. To make it simple, imagine aĬondo in Lee County that sells for $100,000. 75%, not 1.25%, if the homeĭocumentary stamp taxes use a calculation process. Of the property value.) The buyer and seller split the tax. (If the DelawareĬounty imposes no transfer tax, the state can then impose a tax as high as 3% Plus a county transfer tax of up to 1.5% – a total of 4%. Transfer tax at the time of this writing is 2.5% of the property’s sale price In the city of Philadelphia you’ll also pay more than 4%: 3.278% to the city plus 1% to Pennsylvania. HowĪcross the United States, the higher end of the total transfer tax can amount to more than 4.5%, taking the example of Allegheny County, PA (home of Pittsburgh). Transfer taxes can also include taxes imposed by the county or city. Washington State uses the term real estate excise tax. Florida and Pennsylvania use the term documentary stamp tax.Ĭonveyance fee Rhode Island calls it a real estate conveyance tax. The county collects the transfer tax for the state, a stamp goes on The deed transfer tax is distinct from property taxes. Joint ownership in the entire property, the tax is calculated on half of the Is conveyed short of the entire property.

It is also applied to any percentage of the property that

#Real estate conveyance tax in state by state full

It applies to a transfer of full ownershipįrom seller to buyer. Is based on the value of a given property. Transfer tax when real property changes hands.

And the District of Columbia impose a deed

0 kommentar(er)

0 kommentar(er)